Реферат: The City of London and its role as a financial centre

Реферат: The City of London and its role as a financial centre

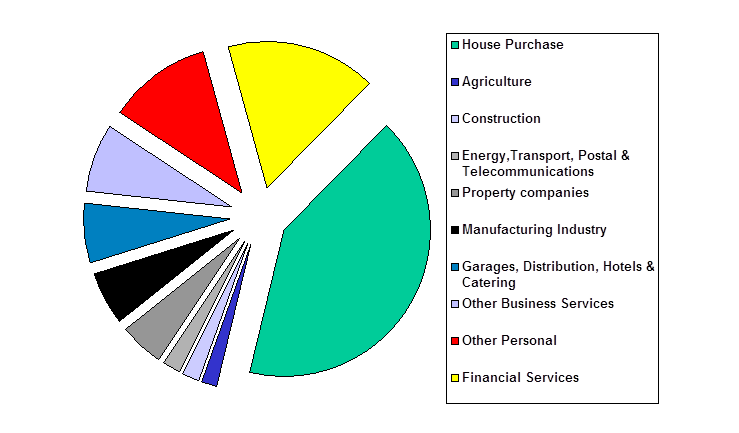

Figure 1.

Major Banks lending to British Residents December 1995.

Table 4.

Largest Building Societies.

|

Rank by Group Assets |

Rank After Flotations and Mergers in 1977 |

Group Assets (million pounds) |

| 1. Halifax. | - | 98,655 |

| 2. Nationwide. | 1 | 35,742 |

| 3.Woolwich | - | 28,005 |

| 4. Alliance & Leicester | - | 22,846 |

| 5. Bradford & Bingley | 2 | 15,658 |

| 6. Britannia | 3 | 14,916 |

| 7.National & Provincial | - | 14,133 |

| 8.Northern Rock | - | 11,559 |

| 9.Bristrol & West | - | 8,589 |

| 10. Birmingham Mdshires | 4 | 6,725 |

| 11. Yorkshire | 5 | 6,412 |

| 12.Portman | 6 | 3,513 |

| 13.Coventry | 7 | 3,379 |

| 14.Skipton | 8 | 3,037 |

Table 5.

Overseas Banks in Britain

(Main Countries Represented).

|

Country of origin |

Branches of an Overseas Bank |

British Incorporated Subsidiary of an Overseas Bank |

Representative offices |

Other |

Total |

|

France |

16 | 8 | 23 | - | 47 |

|

Germany |

19 | 5 | 4 | - | 28 |

|

Italy |

15 | 1 | 28 | - | 44 |

|

Japan |

28 | 6 | 15 | 4 | 53 |

|

Switzerland |

9 | 2 | 17 | - | 28 |

|

United States |

23 | 9 | 11 | 6 | 49 |

|

Other countries |

153 | 41 | 111 | 7 | 312 |

|

Total |

263 | 72 | 209 | 17 | 561 |

Source: Bank of England.

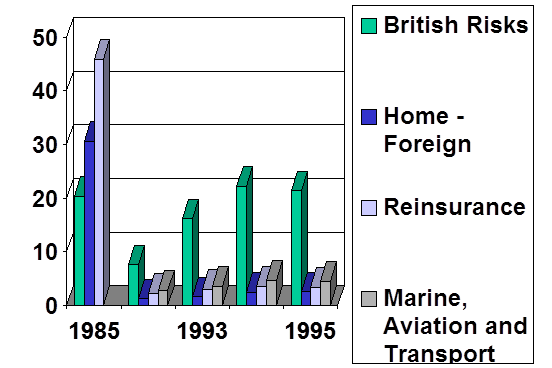

Table 6.

General and Long-term Insurance Business 1985 - 1995.

General Insurance net premiums.

Table 7.

Growth in Unit Trusts and Investment Trusts.

Definitions.

|

Assets - |

anything owned by an individual, company, legal body or government which has a cash value. |

|

Big Bang - |

a system of major changes which brought deregulation to the London Stock Exchange in 1986. |

|

Bill of Exchange - |

an officially signed promise to pay to the receiver of the bill, the stated at the fixed time. |

|

Bond - |

a certificate issued by the borrower as a receipt for a loan usually longer than 12 months; it indicates the interest rate and the date of repayment. |

|

Eurobond- |

an international certificate issued by the borrower for a long-term loan (from 5 to 15 years) in any European currency but not in the currency of the issuing bank. |

|

Securities- |

general term for stocks and shares of all types. |

|

Exchange- |

a market for the toll purchase of goods or securities. |

|

Stock Exchange- |

a market for short or long term transactions in securities . |

|

Commodity Exchange- |

a stable market for wholesale transactions in preferably commodities and raw materials |

|

Money Market- |

a market for money instruments with a period of validity of less than one year. |

|

Factoring- |

a business activity in which a company takes over the responsibility for collecting the debts of another company. |

|

Fund Management- |

managing investors’ funds on their behalf or advising investors on how to invest their funds. |

|

Financial Futures- |

legal contracts for the sale or purchase of financial products on a specified future date, at the price agreed in the present. |

|

Option- |

A contract giving the right to buy or sell financial instruments or goods for a stated period at a stated price. |

|

The London Bullion Market - |

The international gold and silver market in London where trade is done by a telephone or electronic links. |

|

Hedge |

The purchase or sale futures contract as a temporary substitute for a transaction to be made at a later date |

|

Open-Ended Fund- |

A fund without a fixed number of shares |

|

Quite-edged loans - |

Loans issued on behalf of the Government to fund its spending. |